By CreditorWatch Chief Economist Anneke Thompson.

The Reserve Bank of Australia (RBA) continues to be concerned about services inflation, and has increased the cash rate further in order to strip more demand from the Australian economy.

Last month’s March quarter CPI release provided crucial data for the RBA to assess, and while the overall inflation rate has declined from December peaks, services inflation is still rising and may not have peaked. Overall, the quarterly inflation rate was 1.4% over the March quarter, the lowest rate since December 2021 quarter. Inflation for goods fell from an annual rate of 9.5% in December 2022 to 7.6% in March.

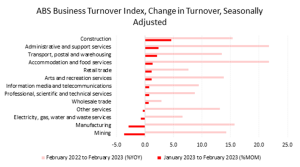

Admin and support and accommodation and food services recorded the largest increases in turnover in the year to February 2023, according to the ABS Business Turnover Index. As well as solid demand, input costs in the restaurant/cafe sector have been the driver of price rises here. Restaurants use a large amount of gas and electricity and are forced to pass these prices rises on to their customers. Despite strong demand and good turnover, the food and beverage service sector has the highest rate of insolvency, according to our March Business Risk Index (BRI) data, as the cost of running these businesses eats into profitability and solvency.

The RBA will be hoping that this latest move will put the economy deep into restrictive territory, and help to slow demand in the services space to ease price rises. However, both energy and rental costs are not responsive to interest rate moves, so it is likely inflation in these areas will prove very sticky.

We are now highly likely to be at the peak of the monetary policy tightening cycle, as the current settings will put enormous pressure on borrowers, particularly those that secured a home loan in the past two years.