A new KPMG report shows Australian retailers must capitalise on the structural shift to online retailing by embracing emerging technology to secure future customer growth.

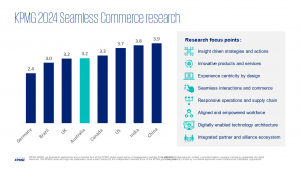

The report ‘Towards seamless commerce’ assesses the maturity of the retail industry in eight major markets: Australia, Brazil, Canada, China, India, Germany, UK and US and their ability to integrate their online and offline offerings to create a seamless experience for the modern consumer.

Australia ranked in the middle of the pack with a maturity score of 3.2 in front of Brazil and Germany and in line with the UK. The index score largely reflects Australia’s strong capabilities in innovative products and services as well as responsive operations and supply chains.

China ranked first amongst leading markets with an index score of 3.9, driven by burgeoning consumer demand for online shopping and payment, and prolonged pandemic lockdowns.

Widespread use of 5G and AI has spurred retail innovation in the country, with intelligent self-service and ‘last mile’ delivery solutions enhancing operational efficiency.

For Australia, sheer physical geography has restricted the development of seamless commerce outside the largest cities in the country.

If local retailers focus on creating more personalised shopping experiences this could accelerate the sectors maturity and the move it towards a more seamless commerce experience like that of China.

Seamless commerce maturity index*

*Scores represent average seamless commerce maturity on a scale of 1-5, where 1 = low maturity and 5 = high maturity.

KPMG Australia Head of Retail and Consumer James Stewart says the recent decline in discretionary consumer spending will not last forever and Australian retailers continue to invest in technology to deliver a seamless integrated customer experience as a business priority.

“The new measure of customer experience is the effective use of data, technology and AI to enhance real-time customer interface everywhere, all at once by enabling core functionality such as, inventory management, order fulfillment, and supply chain, to deliver on the promise,” Mr Stewart said.

Although physical stores and online drive most sales in Australia, the report predicts social commerce is the emerging giant of consumer engagement.

Trends suggest retail growth will be driven by next-generation consumer channels and behaviour with over half of Gen Z initiating purchases through social media, emphasising convenience, ESG and data protection.

“Social media is fast becoming the world’s biggest discovery engine for retail products as the retail experience merges with entertainment while consumers are increasingly comfortable with shopping through their favourite social platforms. Social media assets and influencer support will become a ubiquitous part of the seamless customer experience to capture the next generation of shoppers,” he said.